With a declining housing market and a possible recession, where are the opportunities in 2023?

If you follow the news at all it’s been hard to escape the media drumbeat of “recession next year.” How deep will it be and how long it will last seem to be the only topics up for discussion. Predictions run the gamut: short and deep to long and shallow and variations thereof. Plus, the usual apocalyptic “sell-everything-and-head-for-the-hills” predictions.

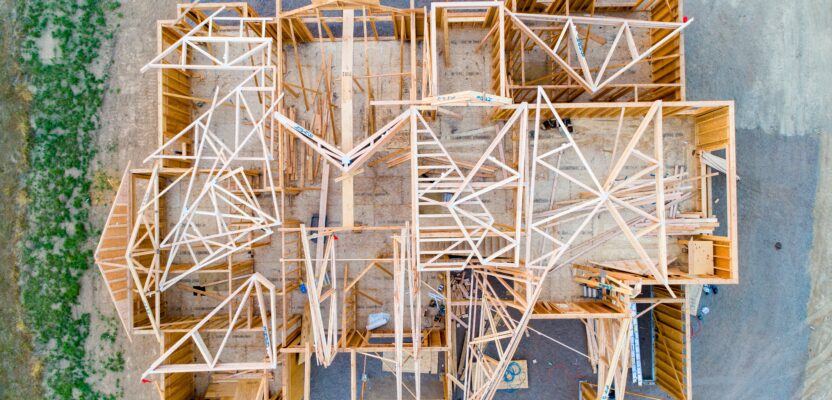

Thanks to rising mortgage rates and high prices, demand for housing is sinking in the U.S., leading to home builders to push the pause button. Industry observers are claiming the U.S. housing sector is already in recession

What does seem clear is housing is taking a beating. While the housing bubble hasn’t burst (yet) home sales are slow thanks to rising interest rates and affordability issues and home builders are taking a breather. I work for a builder and developer, and he has pivoted completely out of home building, solely focusing on land sales.

On a nationwide scale, the National Association of Home Builders (NAHB) has recently weighed in.

“The single-family construction slowdown is not just limited to regions of the country that experienced the fastest production growth over the past year,” said NAHB chairman Jerry Konter, a home builder and developer from Savannah, Ga. “Home-building activity has slowed in nearly all regions, in large and small metro markets as high mortgage rates, elevated inflation, and stubbornly high construction costs act as a drag on consumer demand and housing affordability.”

NAHB chief economist Robert Dietz expanded: “While the bulk of single-family construction continues to occur in the South and lower-density markets, where job conditions are more favorable and housing costs are lower, the data clearly show these areas are acting as a leading indicator for the entire housing market. They are registering the largest production declines, even as other regions—including large metro core and suburban counties—are also displaying weakness as the national housing market has fallen into a recession due to rising mortgage rates and a slowing economy.”

Since housing construction is a major source of revenue for geospatial professionals, especially land surveyors, this is not good news.

Still, throwing in the towel seems premature. Keep in mind that conditions may change. Mortgage rates may soften as the Fed eases up on interest rate hikes, and there is still a tremendous need for housing and a large undersupply. If overvalued housing prices adjust down and mortgage rates moderate, we could see a major uptick in housing construction after a short recession. This is, of course, a best-case scenario but not an unrealistic one.

So, what to do in the meantime?

Looking for other markets

While housing construction itself is slowing, real estate developers are going forward with plans to back-fill future demand for housing. New subdivisions (sans the actual homes) are still moving forward. My surveying friends are busy with boundary surveys, rezone exhibits, subdivision design and subdivision plats, and parcel staking jobs.

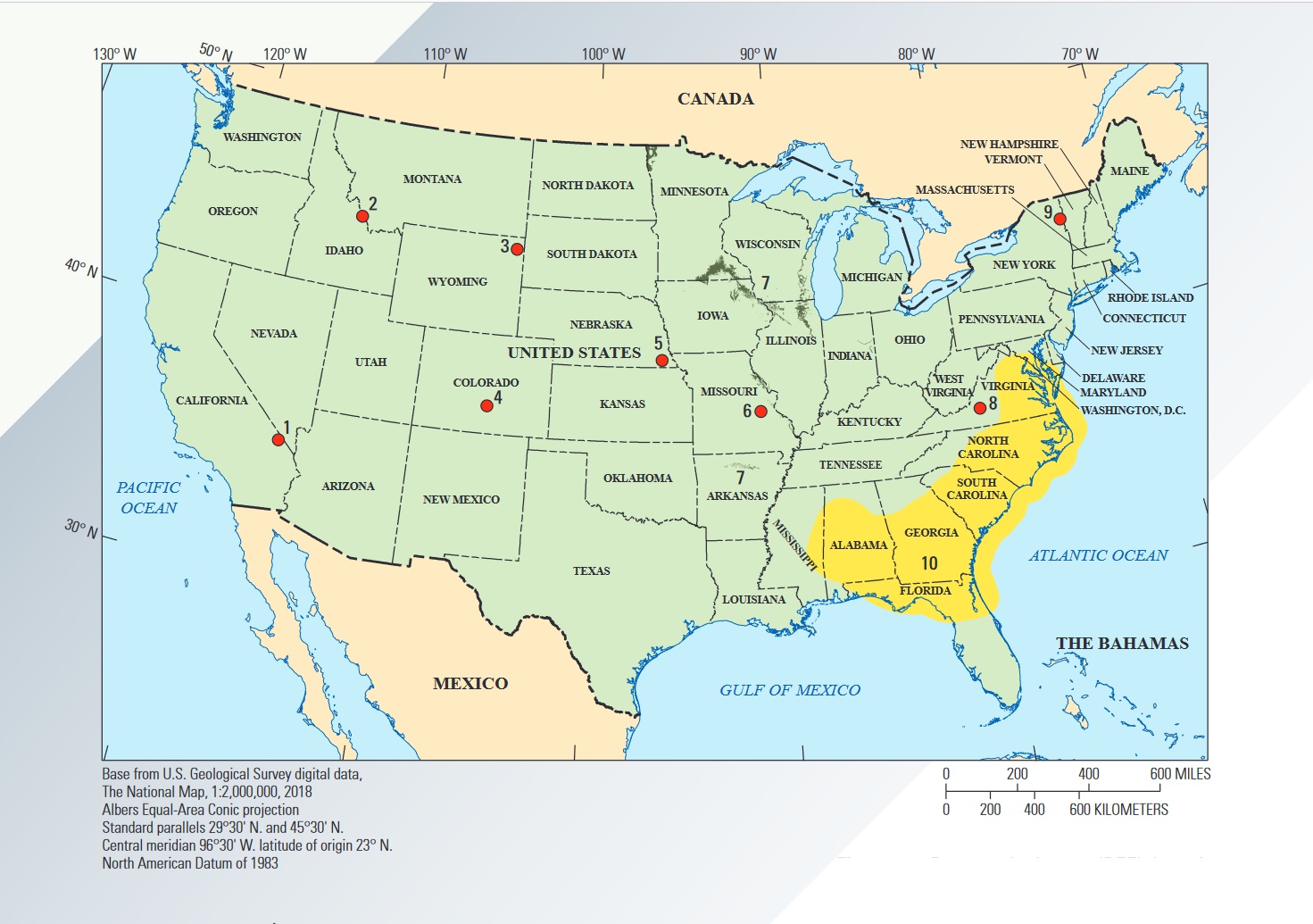

A map of U.S. rare earth elements (REE) mineral deposits. Note the nationwide distribution of these deposits and expect more to be found as demand for REEs expands to meet rising defense and renewable energy needs from domestic sources. Source: USGS “Rare Earth Element Mineral Deposits in the United States” April 2019.

Outside of housing, other industries are growing. Three examples of many are defense, electric vehicles, and renewable energy. The war in Ukraine is depleting the inventories of both the U.S. and its allies and defense spending, both to support the ongoing war effort and replenish these depleted stocks, is on the rise. Raw materials needed to manufacture munitions are vital, so expect mining for those materials to increase as well. Looking at mining, work ranges from prospecting via aerial and remote sensing to locating test holes to volumetric analysis of production efforts. Will new factories need to be built? Probably. So commercial construction may open opportunities as well.

As electric vehicles become popular so does the need for lithium, most of which is sourced from China, South America, and Australia. There is currently only one active lithium mine in the U.S., in Nevada. New and potential lithium mining and extracting projects are in different stages of development in states like Maine, North Carolina, California, and Nevada.

Expansion of mining for lithium, rare earth elements, and other materials in the U.S. could offer geospatial professionals opportunities ranging from prospecting via remote sensing to locating of test holes to volumetric analysis of mining operations. Mountain Pass Mine in southeast California is believed to be the largest rare earth element deposit in the U.S. Credit: Bradley Van Gosen.

Mining of lithium is a mixed bag for environmentalists. On one hand electric vehicles, powered by lithium-batteries, provide an eco-friendly alternative to fossil-fueled vehicles. On the other, mining lithium comes with environmental and community impacts. The Sierra Club alleges it could jeopardize water quality and ranching, and Native American tribes are objecting to some of the proposed sites as they lie on sacred ground. To make matters worse, lithium mining and processing consumes large amounts of water, an increasingly scarce resource especially in the western states.

Still, electric vehicle sales are surging, creating high demand for lithium so a “lithium rush” is ongoing, expect expanded mining in this area.

Renewable energy presents opportunities along the same lines. Windmills, for example, are big users of rare earth materials. The main supplier for rare earth materials is currently China. For obvious geopolitical reasons, the push is on for domestic sources. It should be noted that rare earth elements (REEs) are vital not only to the renewable energy industry, but a wide range of high-tech sectors, including defense. Currently, there are at least 11 REE deposits currently known in the U.S. (See accompanying map.) Expect that number to expand as demand for REEs grow and prospecting uncovers more sources.

There is a host of surveying tasks related to the construction of wind and solar farms. These range from initial siting of individual windmills and solar arrays to right-of-way work on powerlines and even maintenance issues like the inspection of windmills and solar arrays, which are prime work for UAV operations.

Summing up, although home construction will be weak in 2023, many real estate developers are taking the long view and with undersupply at historic levels, are working on future housing developments that can serve as a source of work for geospatial professionals with entitlement and infrastructure tasks. As other industry sectors grow, especially electric vehicles, defense, and renewable energy, they could well prove a source of work as well.

Typically, recessions are followed by economic upturns, so let’s all hope for the best for 2023: a mild (or better yet no) recession with a big uptick in the economy following on. Fingers crossed.