LIDAR

Scanning Offers Diversification Opportunities

Lidar (light detecting and ranging) remains the go-to technology for a host of surveying applications, especially large-scale projects such as transportation infrastructure. An example is showcased in the August issue of PSM: “Making Lewis and Clark Proud” describes how Wilson & Company, Inc. applied mobile scanning (as well as a plethora of other surveying tools including hydrography and aerial imaging) to survey the famous Lewis and Clark viaduct connecting Kansas City, Missouri and Kansas City, Kansas. Among other benefits, the use of mobile scanning allowed the team to locate more than 200 columns, piers, and other structures in a mere fraction of the time that conventional surveying would have taken. Minimizing hazards to surveying crews and impacts to traffic are two additional vital benefits of this technology. Another growing application for 3D scanning is reality capture of important historical and cultural structures. In PSM’s July issue, the feature “Surveying Cultural Heritage” describes the work of the nonprofit organization CyArk as they use 3D scanning to digitally preserve and share such heritage sites as Mount Rushmore.

Another growing application for 3D scanning is reality capture of important historical and cultural structures. In PSM’s July issue, the feature “Surveying Cultural Heritage” describes the work of the nonprofit organization CyArk as they use 3D scanning to digitally preserve and share such heritage sites as Mount Rushmore.

Scanning technology offers opportunities for mainstream surveying firms to diversify their client base. A great example is described in “A Strategic Shift to Ship Scanning,” about how Shrewsbury, UK-based Severn Partnership parlayed their expertise in transportation surveying and scanning into a new market: ship scanning. As the director of Severn Partnership, Nicholas Blenkarn, explains: “We had a desire for business diversification and saw laser scanning as a good place to start, given our complement of transferable skills and deliverables. Our skill-set, derived from tight deadlines and high-accuracy scanning in limited time slots, seemed perfect for the marine industry.”

Their main obstacle to tackling this market was their lack of experience in the marine space. The key to overcoming this roadblock was to take a speculative approach. They met with ship owners and gained permission and access to scan their ships, then processed the data into eye-catching, informative data-sets that they then used to approach prospective clients using a “show-and-sell” strategy. This tactic allowed Severn to expand into an entirely new market.

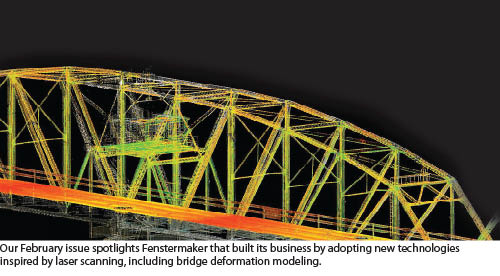

We highlighted another example in “Diversification through Scanning” in the February PSM issue. Fenstermaker turned 3D scanning technology into the foundation for a new division of the company and took on such diverse projects as scanning levees for the Corps of Engineers; oil and gas work scanning offshore platforms, refineries, and plants; and bridge deformation work.

OUTLOOK

The Future of 3D Scanning

The Future of 3D Scanning

We asked Geoff Jacobs, senior vice president of strategic marketing for Leica Geosystems HDS, to compare today’s scanning technology and uses with what he sees down the road.

Scanner size, weight, speed:

Survey-grade scanners have high-speed moving parts and use a fair bit of power, so they won’t be cell-phone small. Moreover, to achieve survey accuracies, an instrument needs a stable form/weight factor. So, a survey-grade scanner’s eventual size/weight will probably be akin to today’s high-end survey instrument. Scanning faster than 1 million pts/sec would help mobile scanning but won’t noticeably benefit static scanning.

Digital imagery:

High-resolution imagery on point clouds is an ultra-friendly interface that will be increasingly popular and will drive innovation in both hardware and software.

Scan resolution:

Higher resolution scans have proven to be more informative and to enable more accurate modeling, so I see a continued trend here.

Mobile:

Just as GPS surveying added “kinematic” methods, so too has 3D scanning. Mobile scanning, however, is less accurate than static scanning. So, its growth will be limited to lower-accuracy applications such as GIS, city modeling, facility management, preliminary design, volumetric surveys, etc.

New scanning technologies:

A new scanning technology for low-cost and handheld scanners relies on a structured light projector/sensor used in video games (e.g. Microsoft’s Xbox Kinect). Designed to sense people in a living room, it has inherent range, ambient-lighting, and accuracy limitations that will constrain its use to small, interior measurement projects. New “phase-array lidar” uses a fixed array of ranging lasers, but looks like it still has a way to go to meet surveying needs.

Software:

Advances in point cloud software and computing will continue to ease converting point clouds into deliverables. Some eye-popping advances are on the horizon, but it’s not clear how far away they are. Moreover, they are not “one-button” steps for making complete maps and models from scans. My guidance is to focus on becoming proficient with today’s steadily improving tools—just as thousands of users already do.

Integration of 3D scanning with other tools:

Just as GPS became integrated into other instruments and software, the same will apply to 3D scanning. For example, 1,000 pts/sec scanning, digital imaging, and robotic total station functionality were introduced in 2013 as an integrated instrument. Likewise, point cloud capabilities will be increasingly integrated into survey, CAD, and asset management software.

Price:

The most versatile and productive, dedicated survey-grade scanners will continue (based on manufacturing costs) to be priced above high-end, conventional survey instruments. Scanners with reduced versatility and productivity (e.g. less range, slower, less accurate, etc.) will be priced lower, reflecting their specific capabilities. The previously mentioned scanning add-on for a robotic total station was introduced at around $10,000, boding well for the future.

On the software side, high-end “do everything” solutions will continue to command premiums over standard survey and CAD software. Scanning software with reduced features, such as point cloud plug-ins for CAD, will be priced around the standard CAD and survey software range. Free point cloud software for simple viewing and measurement will proliferate.

Applications and implications for surveyors:

3D scanning is already used for almost every type of traditional, survey mapping application, and the frequency of its use will only increase. Surveyors will also increasingly use 3D scanning to diversify into new markets, e.g. plant as-builts, BIM, ships, forensics, movie sets, and others.

In the future, new diversification opportunities will emerge, e.g. insurance claim assessments, real estate marketing, and preliminary design for home remodeling. However, I think professionals already in those fields would mostly service these markets using low-end scanning solutions.

As potentially beneficial as 3D scanning can be, I think some surveyors will continue to balk at it. Why? Understandably, many land surveyors prefer to work in the great outdoors on boundary and land development projects, but these are not sweet spots for 3D scanning. Instead, I think 3D scanning will flourish most amongst surveyors who are excited by the technology and its potential business benefits, regardless of the type of surveying service they offer or where they perform it.